Meetup Recap: Wallets, Security, and the Art of Paper Bitcoin

Our latest Thursday meetup was a deep dive into the wild world of Bitcoin wallets—mobile, desktop, hardware, and even paper!

Hey Bitcoin Bay crew! Our latest Thursday meetup was a deep dive into the wild world of Bitcoin wallets—mobile, desktop, hardware, and even paper! Two speakers lit up the night: one breaking down the convenience-vs-security trade-off with tools like Sparrow and SeedSigner, and Daniel from Polymerbit unveiling the coolest paper wallets we’ve ever seen. Here’s the scoop on this wallet-packed session!

Key Ideas from the Meetup

- Convenience vs. Security Trade-Off: The easier a wallet is to use—like mobile Lightning apps—the less secure it is; the more secure, like multi-sig cold storage, the less convenient.

- Wallet Spectrum Unveiled: From Phoenix for daily spending to Sparrow for desktop control and SeedSigner for long-term savings, each wallet serves a purpose based on your Bitcoin needs.

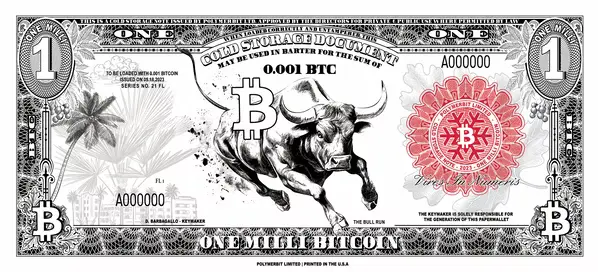

- Paper Wallets Reimagined: Daniel’s Polymerbit project transforms paper wallets into durable, collectible art with scratch-off private keys—perfect for small amounts or orange-pilling newbies.

- Bitcoin’s Practical Power: Whether it’s peer-to-peer cash or tamper-proof storage, wallets tie directly to Bitcoin Bay’s mission of real-world, censorship-resistant use.

Unpacking the Meetup: A Wallet Masterclass

The night kicked off with a wallet rundown from a Bitcoin Bay regular, starting with mobile options. “I love Phoenix,” they declared, praising its Lightning-native design. “It’s stored in Lightning, but you can do on-chain transactions—perfect for cash spending.” Moon (M-U-U-N) got a nod too, though it’s trickier when fees spike since it’s on-chain by default. Both shine for quick, low-value transactions—think a few million sats, not millions of dollars. “I’m not keeping $2,000 in my pocket,” they quipped, “just like I wouldn’t hoard sats on my phone.”

Custodial wallets like Strike and Cash App came up next—convenient and low-fee since they update internal ledgers, not the blockchain. But there’s a catch: “They’re at risk due to KYC,” the speaker warned. “They have your money, so they need to know who you are—Bank Secrecy Act stuff. That’s why we’re peer-to-peer cash maxis here.” Breaches mean $5 wrench attacks, so non-custodial is the way to go.

Desktop wallets took center stage with Sparrow, an open-source gem by Craig Raw. “It’s super powerful yet simple,” they enthused. “Use it as a hot wallet—sign and send—or plug in a SeedSigner, Coldcard, or Ledger for extra security.” Sparrow’s versatility shines: connect it to your Bitcoin node, label transactions, or set up watch-only wallets for cold storage. “Back when Coinjoins were a thing, you could do them right in Sparrow—no hot phone wallet needed.”

Hardware wallets brought the security talk home. “SeedSigner’s my favorite—pairs beautifully with Sparrow,” they said. Coldcard, Ledger, Jade, and Foundation also made the list. These are for long-term savings, not quick spends. “If your device is gone, import the paper backup into a hot wallet and send,” they explained. The catch? You need the device (or seed) to sign transactions, trading convenience for ironclad protection.

The core lesson? “The more secure something is, the less convenient,” they noted. “A bank vault’s not easy to crack, but it’s a pain to access.” Mobile wallets like Wallet of Satoshi (custodial, non-KYC, Lightning-enabled) are the simplest, while multi-sig setups—say, 2-of-3 keys spread across locations—are the Fort Knox of Bitcoin. “For daily spending, go Lightning mobile; weekly, a hot Sparrow; long-term, multi-sig cold storage,” they advised. Sparrow even simplifies multi-sig backups with QR-coded descriptors—just don’t overcomplicate with BIP39 passphrases. “Keep it simple, stupid,” they laughed. “More people lose BTC to forgotten passphrases than theft.”

Then came Daniel from Polymerbit, unveiling paper wallets on steroids. “I started this in 2016 with university friends,” he shared. “It was a hobby that exploded.” These aren’t your 2013 QR-code-on-paper flops—these are durable, collectible bills with scratch-off private keys. “Load the public key, trade it like a $100 bill, then scratch off the private key to redeem,” he explained. Most are 1 mBTC (0.001 BTC)—safe for small amounts or gifting. “They look like money to orange-pill people,” he added, showing off UV fibers, microtext, and tamper-evident layers.

Risks? Plenty. “Generate keys on an air-gapped Raspberry Pi, flush the RAM, smash the printer after,” Daniel advised. Third-party key makers like Polymerbit face rug-pull risks—think Cold Key’s 2023 fiasco—but longevity and accountability help. “We’re a UK company—legally liable if keys go wrong,” he said. Still, he cautions against big loads: “What’s small now could be huge later with fiat debasement.” Shipping loaded bills? “Fly them yourself—FedEx lost 3 BTC once!”

Join the Bitcoin Bay Movement!

This meetup was Bitcoin Bay in action: practical tools for a censorship-resistant life. From Lightning spends to paper wallet art, it’s all about real-world use. Catch the vibe at our Thursday meetups—next up, the Mises event (Feb 22nd) and St. Pete Social (March 1st). Don’t miss Bitcoin Day Tampa and our June 14th Soiree at the River Center! Join us every Thursday—grab some BTC, master your wallet, and let’s build a freer Tampa Bay together!